For beginners venturing into the world of options trading, navigating through a myriad of signals can be daunting. Options trading signals serve as crucial indicators for making informed decisions, but identifying reliable signals is key to success. In this beginner's guide, we'll explore essential factors to consider when evaluating options trading signals, empowering newcomers to make well-informed trading decisions.

1. Understanding Options Trading Signals:

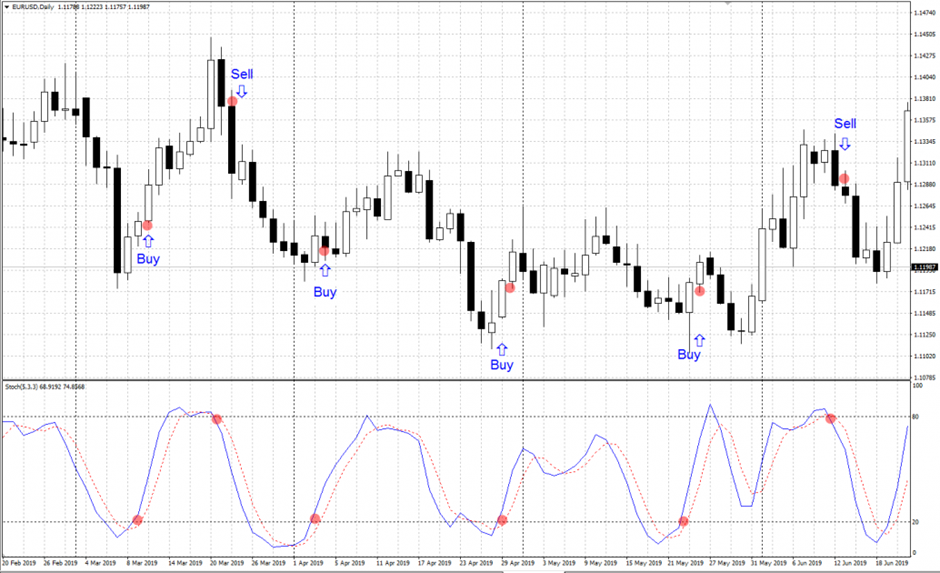

- Define options trading signals: Signals generated by various indicators, algorithms, or expert analysis, providing insights into potential trading opportunities.

- Significance of signals: Signals help traders identify entry and exit points, anticipate market movements, and manage risk effectively.

- Types of signals: Signals may include technical indicators, fundamental analysis, sentiment analysis, or a combination of these factors.

2. Factors to Consider When Evaluating Signals:

a. Accuracy:

- Assess historical performance: Look for signals with a track record of accuracy in predicting market movements.

- Verify consistency: Ensure that signals consistently generate profitable trades over time, rather than relying on isolated instances of success.

b. Source Credibility:

- Research signal provider: Evaluate the reputation and credibility of the signal provider or source, considering factors such as expertise, experience, and transparency.

- Seek independent verification: Look for signals that are supported by reputable third-party analysis or validation to confirm their reliability.

c. Compatibility:

- Align with trading strategy: Choose signals that complement your trading style, goals, and risk tolerance, whether it's day trading, swing trading, or long-term investing.

- Consider asset class and timeframe: Ensure that signals are applicable to the specific assets and timeframes you intend to trade, whether it's stocks, options, forex, or futures.

3. Transparency and Documentation:

- Clear methodology: Opt for signals that provide transparent explanations of the underlying methodology or criteria used for generating signals.

- Access to historical data: Look for signals that offer access to past signals, performance metrics, and trade outcomes for thorough analysis and verification.

4. Trial Period and Support:

- Trial period availability: Choose signal providers that offer a trial period or demo account for testing signals before committing to a subscription.

- Customer support: Consider the availability of customer support, including responsiveness, accessibility, and assistance with signal interpretation or troubleshooting.

Conclusion:

Options trading signals can be valuable tools for beginners seeking to navigate the complexities of the financial markets. By considering factors such as accuracy, source credibility, compatibility, transparency, and support, novice traders can effectively evaluate options trading signals and make informed decisions. Remember to conduct thorough research, test signals in a demo environment, and seek guidance from reputable sources to maximize your chances of success in options trading.